How Much Do I Need to Save for Retirement?

We get this question often. While planning for retirement can feel overwhelming, it becomes more manageable when you break it down into two key questions:

- How much money will I need each year during retirement?

- How much will I have saved by the time I retire?

How Much Money Will I Need Each Year During Retirement?

Short answer: It depends on your retirement budget.Your spending needs during retirement will likely look different from your current expenses. Some costs may decrease, while others could increase.

You may spend less on:

- Commuting or work-related expenses

- Housing, especially if your mortgage is paid off or you move to a lower-cost area

- Income taxes, if you withdraw less annually (your “retirement income”) than your current income

- Supporting children, if they are financially independent

- Travel or leisure activities

- Healthcare costs

- Long-term care or assisted living

Once you have an estimated annual retirement budget, multiply that by the number of years you expect to be retired. This gives you a rough estimate of your total retirement needs. Ways to meet these needs could include: retirement investments, SocialSecurity, salary (if you continue working part-time or full-time), or other support.

For example: An individual may estimate they will spend $60k in their first year of retirement at age 65. Assuming 2% inflation and a 4% return on their retirement assets going forward, that person will need $965,500 at age 65 to have enough money to last to age 85, if they rely only on their retirement investments.

You can input the following prompt in an AI tool to adjust it to your own example: Without rounding any of the sub calculations, what is the net present value, assuming an annual rate of return of [assumption for annual return] of the total amount spent each year, for [assumption for number of years] years, starting at [assumption for annual expenses] in year 1, assuming [assumption for inflation] annual inflation? For example: “Without rounding any of the sub calculations, what is the net present value, assuming an annual rate of return of 4% of the total amount spent each year, for 20 years, starting at 60000 in year 1, assuming 2% annual inflation?"

Now that you’ve estimated how much you’ll need, the next step is to figure out how much you’ll likely have saved by the time you retire.

How Much Will I Have Saved by the Time I Retire?

Short answer: It depends on how much you’re saving now.Your current saving habits are the foundation of your retirement nest egg — but what really drives long-term growth is the impact of compounding.

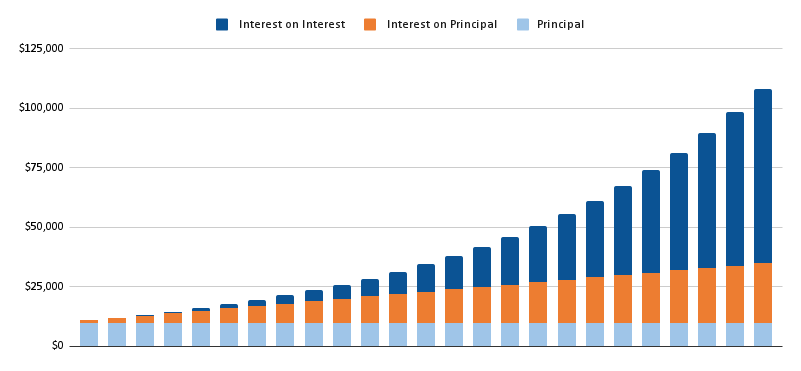

Compound interest, for example, means your savings earn interest, and then that interest earns more interest. The earlier you start, the more powerful this effect becomes as illustrated in the following chart.* The light blue represents your principal, or the dollars you contributed directly. In this example, there was a one-time principal investment at the beginning, so you can see the light blue bar height stays the same over time. The orange represents the direct interest on that principal amount growing over time. But after 25 years, the vast majority of the dollars is the dark blue portion of the bar, which represents the interest earned on interest over the years. This is the power of compounding growth.

At the same time, inflation reduces your money’s purchasing power over time. A dollar today probably won’t stretch as far 30 years from now, so it’s important to account for inflation when setting your savings goals.

At the same time, inflation reduces your money’s purchasing power over time. A dollar today probably won’t stretch as far 30 years from now, so it’s important to account for inflation when setting your savings goals.

A general rule of thumb is to save 12%–15% of your income each year, including any employer contributions. But this is just a starting point. The ideal savings rate depends on several factors: your age, planned retirement age, lifestyle goals, and life expectancy.

To get a personalized estimate of how much you will have saved by the time you retire, use a compound interest calculator to see how your current savings rate will grow over time. However, keep in mind that your money doesn't have to just sit idle during retirement—it may continue to grow if it's still invested. A conservative “retirement” portfolio (e.g. with a 40% stocks/ 60% bonds allocation) may provide modest growth and income.

Example continued: The same individual is currently contributing $500 monthly to their 401(k) and has 33 years left until they are 65 years old. Using the compound interest calculator, they will have approximately $713,600.55 if their estimated annual interest rate is 7%. Note: During retirement, you may get income from sources outside of your retirement investment accounts. For example, Social Security might help you cover your costs.

Compare Your Answers

Compare the projection from the calculator to the total amount you estimated you’ll need in retirement. Noting that Social Security or other income may help fund your retirement, this comparison will give you a sense of whether you’re on track, or whether it’s time to adjust your savings plan.Example continued: This individual estimated they will need a total of $965,500 for the 20 years they are retired. However, they are on track to have approximately $713,600.55 at age 65 according to the interest rate and compounding growth during the 33 years. This individual now has a comparison to decide how they may want to adjust their savings rate.

The bottom line is that there is no perfect or one-size-fits-all answer to the question of how much you need to save for retirement. Given that there are so many factors we can’t know or predict, the best we can do is use what we know now to create an educated guess. Start now, revisit your plan regularly, and don’t hesitate to seek advice if needed. Your future self will thank you.

Hungry for more knowledge? Read on to learn how having a long-term investment strategy may help you through a recession.

If you don’t have a retirement investing account, or if your employer contracts with a different retirement plan provider, we’d love to show you Just Futures’ services! Contact us: info@justfutures.com.

~Ady, Senior Business Development Associate

*Assumptions: $10,000 principal, 10% interest rate, 25 years. Disclosure: This is a hypothetical example that is demonstrating a mathematical principle. It does not illustrate any investment products and does not show past or future performance of any specific investment.

This material is for general information and educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Just Futures explicitly disclaims any responsibility for product suitability or suitability determinations related to individual investors. Investing involves the risk of loss that clients should be prepared to bear. No investment process is free of risk; no strategy or risk management technique can guarantee returns or eliminate risk in any market environment. There is no guarantee that your investment will be profitable. Past performance is not a guide to future performance. The value of investments, as well any investment income, is not guaranteed and can fluctuate based on market conditions. Just Futures shares third-party links and references solely to share sources and social, cultural and educational information. Any reference in this post to any person or organization, or activities, products, or services related to such person or organization, or any linkages from this post to the web site of another party, do not constitute or imply the endorsement, recommendation, or favoring of Just Futures, or any of its employees or contractors acting on their behalf. Just Futures does not guarantee the accuracy or safety of any linked site. Published August 14, 2025 Updated September 20, 2025