You should think about fees. Here’s how.

Fees are not sexy. But when it comes to retirement investing, fees can make a big difference in how much money you end up with.

Why should I care about fees?

Every dollar you pay in fees is a dollar that doesn’t go into your investment account. Those dollars are missed opportunities for compounding growth. For example, if you pay $5 per month in fees, that is not just $5 less going into your account. Over 40 years, that $5 per month could grow to about $10,000.1 And you don’t get any of that growth.

If you think you are not paying fees, you may be mistaken.

How do I know which fees I’m paying?

Investment account providers use various terms to describe fees. But a workplace retirement plan (e.g., 401(k) or 403(b)) typically involves three main kinds of fees: administration fees, investment management fees, and fund fees. Individual account providers (e.g., IRAs or individual taxable accounts) typically charge fund fees. They sometimes also charge administration fees or investment management fees.

Administration fees: some plans charge these fees to you. Other plans charge them to your employer. If you’re paying administration fees, you may be able to find them on your account statement. Just Futures also recommends reading your plan provider’s fee disclosure document. If a document says the “plan,” “participant,” or “employee” pays, it means you are paying. If it says the “plan sponsor” or “employer” pays, then your employer is paying.

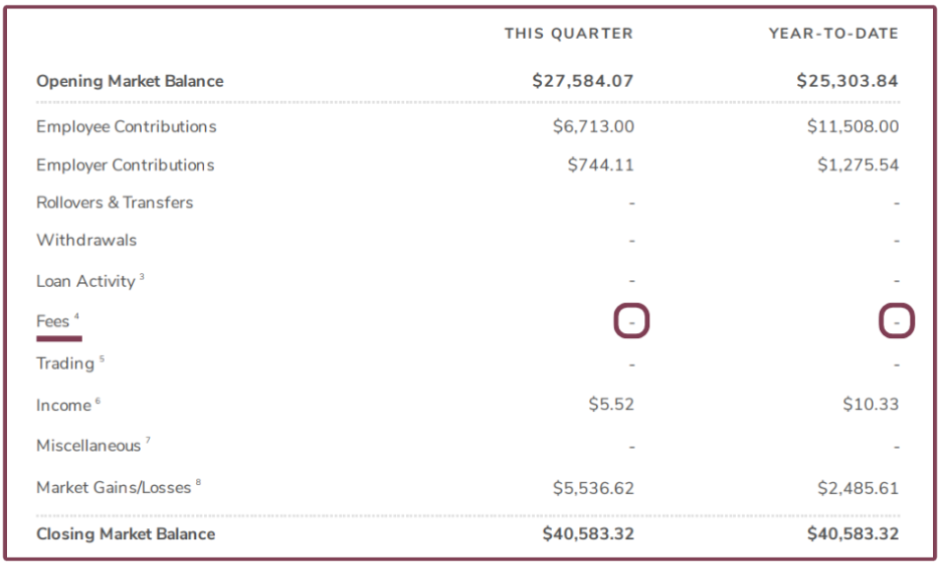

Here’s an example of a quarterly account statement:

This example is hypothetical and only to illustrate.

This example is hypothetical and only to illustrate.

This employee is not paying any administration fees.

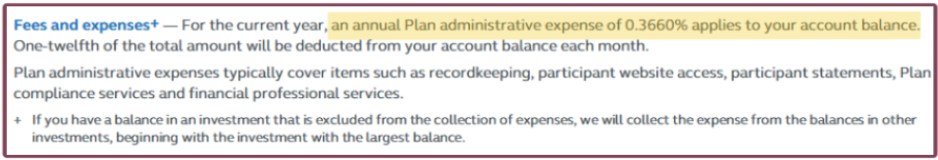

Here’s an example fee disclosure excerpt:

This example is hypothetical and only to illustrate.

This example is hypothetical and only to illustrate.

This part of the fee disclosure confirms that this employee is not paying any administration fees.

Here’s another example:

This example is hypothetical and only to illustrate.

This example is hypothetical and only to illustrate.

For this plan, the administrator automatically takes 0.366% of the money in your account each year.

Unfortunately, fee disclosure documents tend to be long. And you’ll probably have to read the fine print to fully know what you’re paying.

Investment management fees: not all plan providers charge these fees. If your plan provider charges investment management fees, they may charge them to you. Or they may charge them to your employer. Like with administration fees, you can look to your account statement and fee disclosure document to see how much you’re paying.

Fund fees: other names for fund fees include “expense ratio,” “fund expenses,” or “total expense ratio (TER).” You, the employee, always pay this fee. Fund managers show this fee as a percentage of fund assets. Unlike administration and investment management fees, fund fees are not on your account statement or invoice. Instead, you can find out about your fund fees by following these three steps:

- 1) Find out which funds you’re invested in. Log into your account and look for information about the investment strategy. From there, you should be able to see the names of the funds where your money is invested. If you can’t find this information, contact your plan provider and ask them for help.

2) Locate the fund prospectus for each fund where you’re invested. Once you’re in your account and you see the names of your funds, you should see an option to view the prospectus for each fund.

3) Find the fund fees in the prospectuses. Look for the terms “expense ratio,” “fund expenses,” or “total expense ratio (TER).”

This example is hypothetical and only to illustrate.

This example is hypothetical and only to illustrate.In the example above, the total fund fee is the sum of the fund management fees, distribution and service fees, and other expenses. For example, if you invested $1000 into this fund, the fund would charge you $6.80 this year. [Note: some funds come with different share classes, for different kinds of investors. Typically, for a retirement account investor, the share class is one of the Rs.]

Some plans charge additional fees. The fee disclosure document should list them.

Plan providers often make fee disclosures hard to understand. So, if your documents seem unreadable, it’s not your fault. But you have a right to understand the fees you’re paying. So talk to your employer or plan provider to get more explanation.

How do I know if my fees are too high?

Answering this question can get complicated, because plan services vary. But industry standards can help you gauge whether fees are reasonable. 2023 data from the 401(k) Averages Book provides industry averages of costs as a percentage of total assets in the plan.- Administration fee: industry average is 1.75%.2

- Investment management fee: industry average is 0.64%.2

- Fund fee: industry average is 0.42%.2

What should I do if my fees are too high?

If your account is through your employer (e.g., a 401(k) or 403(b)), consider talking to your human resources point of contact. They may not be aware of current industry averages. But they do have a responsibility to you and your colleagues. To help protect your financial interests, they may be able to:- Negotiate lower fees with the plan provider

- Take on some of the fee burden, instead of passing the fees onto you and your fellow

- Switch to a different provider that charges lower fees

If your account is an individual account (e.g., an IRA or individual taxable account), you might want to consider switching to a different provider. If you are comparing providers, try to compare all the fees. Also consider account features, for example, investment options, values alignment, and ease of platform.

Want to align your money with social justice values? Check out Just Futures’ IRAs or individual taxable accounts.

Just Futures: committed to affordable, easy-to-understand fees

Just Futures understands that you deserve an affordable, understandable way to save for retirement. In 2021, before we were a company, our founders wanted to know whether everyday workers had this kind of retirement savings choice. So, they looked into it. They surveyed 200 nonprofit workplaces. They learned that many nonprofit workers do not have a workplace retirement plan. And, for workers who do have a workplace retirement plan, the fees are often high or hard to understand.So, our founders built Just Futures. Now, we are proud to offer retirement investment services to ordinary workers. We work to keep your fees low, so more of your money can go toward helping you enjoy retirement. And we try to communicate our fees clearly.

Based on industry averages, Just Futures’ all-in fees for workplace retirement plans may be up to 25% lower than the industry average.3

We’re proud to be helping businesses and nonprofits, even ones with just a few staff members, get affordable, transparent retirement plans. Our clients often thank us for giving clear information. Here’s what one client said after the training we give when a workplace starts a retirement plan with us:

“It was fantastic! Better than any info I've gotten from our last company in tutorials or 1-on-1s. Thank you!”4

We’re also thrilled to be bringing our values-aligned, user-friendly, and cost-competitive model to individual accounts, including Roth and traditional IRAs, and individual taxable accounts.

Hungry for more knowledge? Read on if you’re thinking about how much to save for retirement.

If you don’t have a retirement investing account, or if your employer contracts with a different retirement plan provider, we’d love to show you Just Futures’ services! Contact us: info@justfutures.com.

~Lisa, Sales & Digital Engagement

1This calculation assumes a 6% annual rate of return.

2This information is provided for illustrative purposes only, and is not intended to be taken as investment or tax advice. Consult a qualified tax and financial advisor to determine the appropriate investment strategy for you. These averages are based on 401(k) plans with 25 participants and $250,000 in assets, according to the 24th edition of the 401k Averages Book, with data updated through September 30, 2023, page 15.

3This information is provided for illustrative purposes only, and is not intended to be taken as investment or tax advice. Consult a qualified tax and financial advisor to determine the appropriate investment strategy for you. The average total bundled cost for 401(k) plans with 25 participants and $250,000 in assets is 2.81% of assets, according to the 24th edition of the 401k Averages Book, with data updated through September 30, 2023, and is inclusive of investment management fees, fund expense ratios, recordkeeping & plan administration fees, and other asset-based fees. Just Futures’ age-based and risk-based models have blended expense ratios ranging from 0.20% to 0.24%, and our investment management fee for nonprofits is 0.30%. Combined asset-based fees can be as low as 0.50%. For a plan with 25 participants on Vestwell’s Plus pricing tier, a Plan Sponsor will pay $1,920 in base fees and $2,100 in per-participant fees. That makes up 1.6% of $250,000, making total costs as low as 2.1% of plan assets.

4This client’s experience does not represent other clients’ experience. This quote does not guarantee future performance or success. Just Futures did not compensate this client for this testimonial.